The Employees' Provident Fund Organisation (EPFO) is one of the largest social security organisations in India, established under the Employees' Provident Funds and Miscellaneous Provisions Act, 1952.

It operates under the Ministry of Labour and Employment, Government of India. EPFO primarily manages the Employees' Provident Fund (EPF), a retirement savings scheme aimed at providing financial security to employees post-retirement.

| For Employers :→ | Log In |

| For Employees :→ | Log In |

| For International Workers :→ | Log In |

| For Pensioners :→ | Log In |

UAN Login

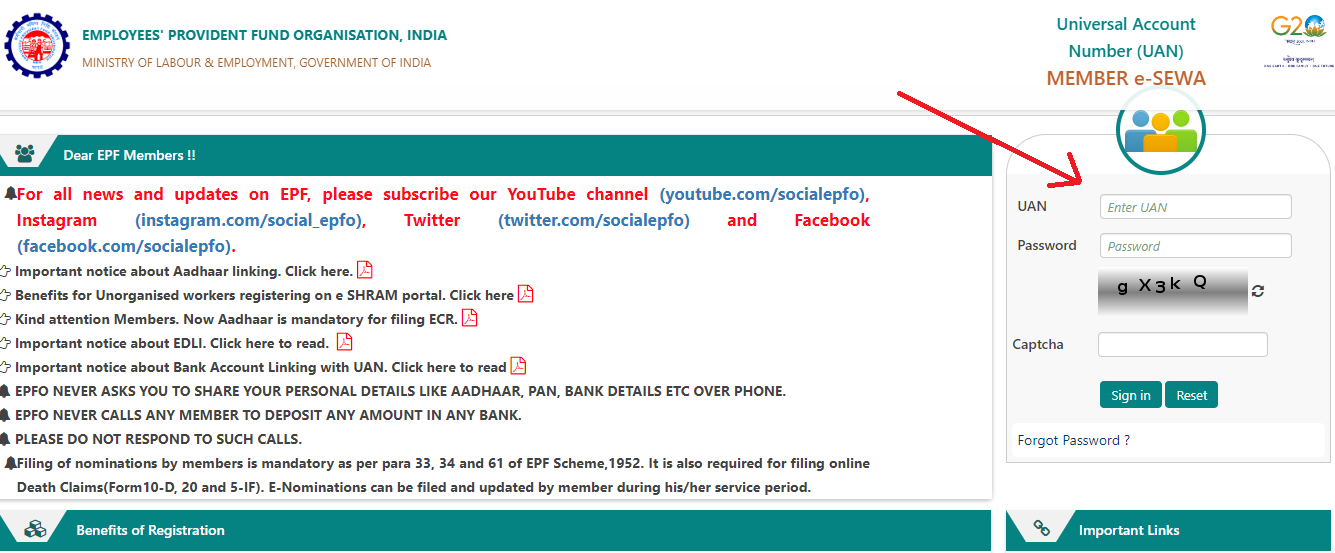

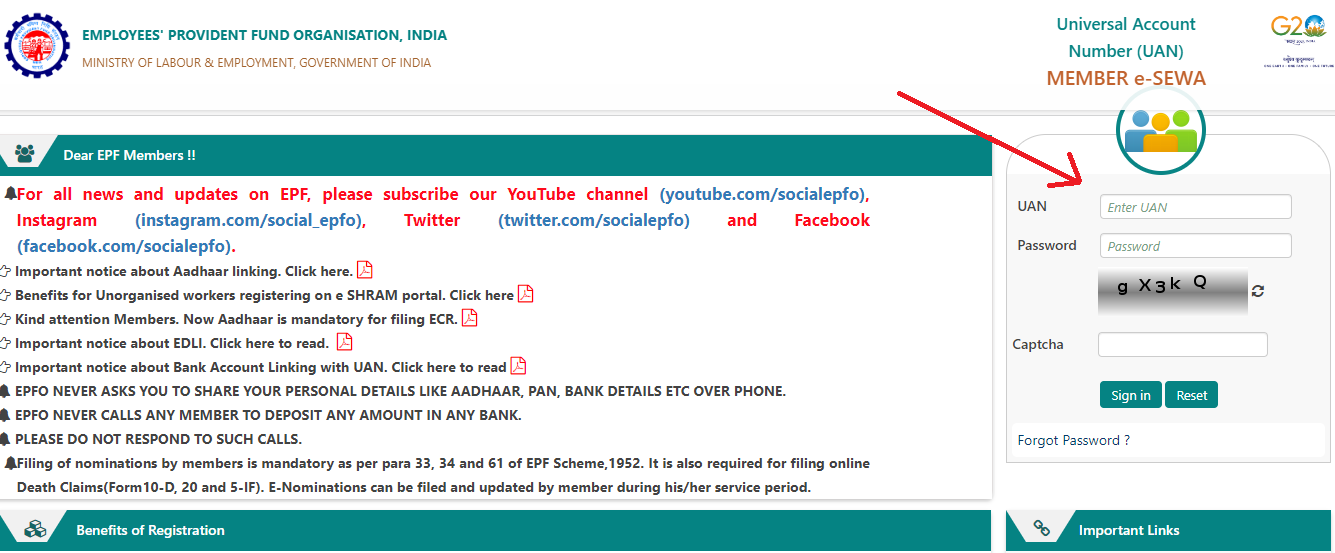

The UAN (Universal Account Number) login process allows employees to access the EPFO Member Portal for managing their EPF accounts, checking balances, and filing claims.

Below is a detailed step-by-step guide for logging into the UAN portal.

- Visit the EPFO member portal: https://unifiedportal-mem.epfindia.gov.in/memberinterface/.

- Enter your UAN (Universal Account Number) and password, and lastly, complete the captcha verification.

EPF Passbook & Claim Status

The EPF Passbook is a detailed record of all transactions related to an employee's provident fund account, including monthly contributions from the employee and employer, interest earned, and withdrawals.

- Access the EPFO member portal and log in using your UAN and password.

- Click on "View Passbook" to see your detailed EPF statement, including contributions, interest earned, and the total balance.

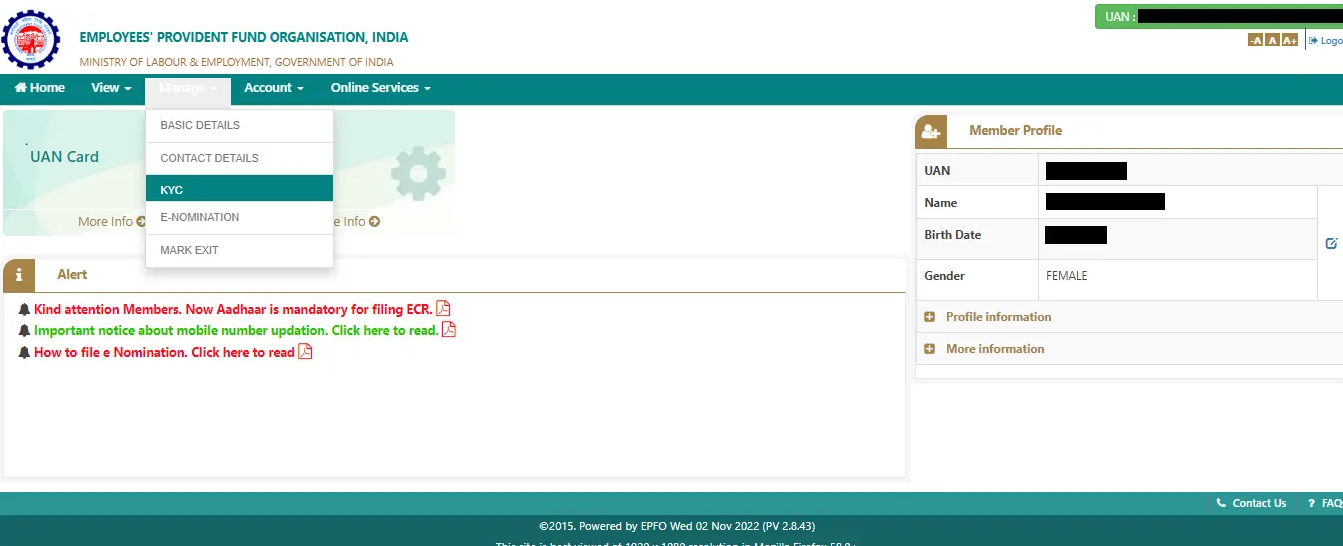

Member KYC

The KYC (Know Your Customer) process for EPFO (Employees' Provident Fund Organisation) members is essential for linking your UAN (Universal Account Number) with your bank account, Aadhaar, PAN, and other important documents. This helps streamline services like withdrawals, transfers, and accessing EPF online facilities.

Below is a step-by-step guide to complete the EPFO member KYC process.

- Access the EPFO member portal and log in using your UAN and password.

- Go to the "Manage" tab and select "KYC."

- Select the document you want to update (e.g., Aadhaar, PAN, bank details).

- Fill in the required details of the document and click "Save."

- Lastly, your employer will need to approve the KYC update for it to become effective.

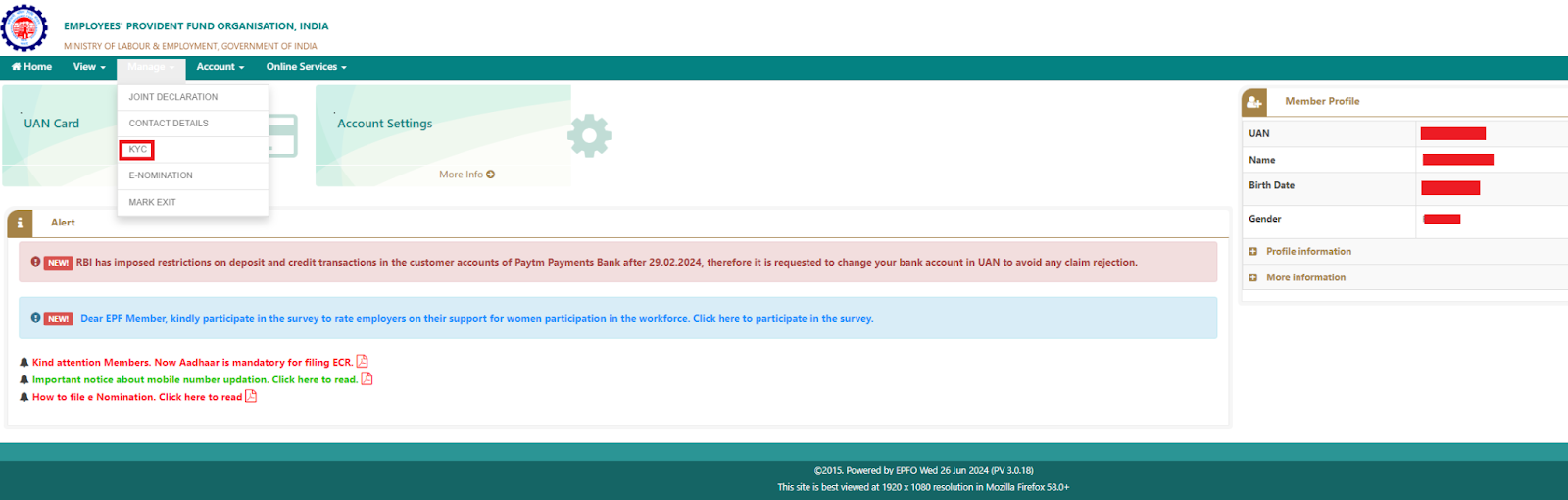

EPF Online Claim (Withdrawal)

The EPF (Employees' Provident Fund) online claim facility allows members to withdraw their PF funds for various purposes, including retirement, unemployment, marriage, education, and medical emergencies.

This process is simple, fast, and does not require a visit to the EPFO office. Here's a complete guide to filing an online claim for EPF withdrawal.

- Visit the UAN Member e-Sewa portal and log in using your UAN and password.

- Next, you need to ensure your KYC details (Aadhaar, PAN, bank details) are verified under the "Manage" tab.

- Navigate to "Online Services" and select "Claim (Form 31, 19, 10C, 10D)."

Choose the appropriate reason for your withdrawal from the available options.

| Purpose of Withdrawal | Minimum Years of Service | Maximum Amount Allowed | Additional Conditions |

| Medical treatment (self, spouse, children, parents) | None | 6 times the monthly basic salary + dearness allowance (DA) or employee's share with interest, whichever is less | No service requirement |

| Marriage (self, children, siblings) | 7 | 50% of employee's share with interest | |

| Education (self or children, post-matriculation) | 7 | 50% of employee's share with interest | |

| Home purchase/construction | 5 | Up to 36 times the monthly basic salary + DA or total cost, whichever is lower | Property must be in the member's name or jointly with the spouse. |

| Home Renovation | 5 | Up to 12 times the monthly basic salary + DA or employee's share with interest, whichever is lower | Property must be in the member's name or jointly with the spouse. This can be availed twice during service. |

| Home loan repayment | 10 | Lower of the following: 36 times monthly basic salary + DA Total outstanding loan amount Employee's share with interest |

Property must be in the member's name or jointly with the spouse. |

| One year before retirement | None | Up to 90% of the accumulated balance |

- Provide your bank account details and select the relevant form based on your withdrawal type.

- An OTP will be sent to your registered mobile number for verification.

- Review all the information and submit the form.

Withdrawal Forms

Each type of withdrawal requires a specific form:

- Form 19: For complete withdrawal upon retirement or leaving service.

- Form 31: For partial withdrawal or advances.

- Form 10C: For withdrawal benefits/scheme certificate from EPS (Employees' Pension Scheme) for members who have not completed 10 years of service.

- Form 10D: For claiming monthly pension benefits after retirement with at least 10 years of service.

- Form 20: For the nominee or legal heir to claim benefits in the event of the member's death.

- Form 5(IF): For claiming insurance benefits under EDLI in case of death during service.

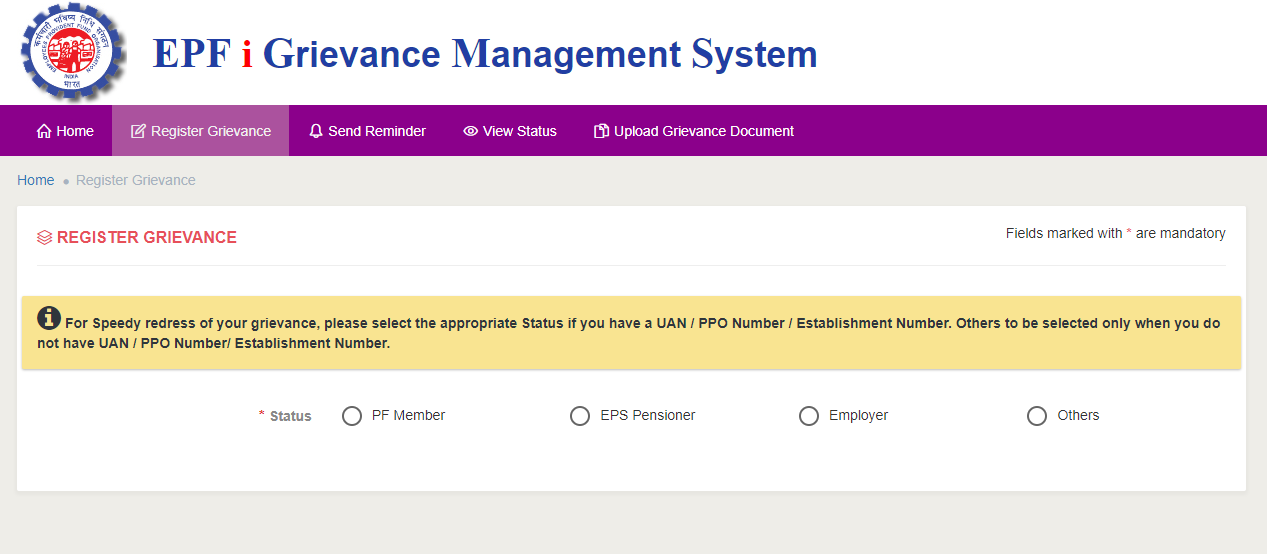

Grievance Registration (EPFiGMS)

The EPFO Grievance Management System (EPFiGMS) is a dedicated platform for Employees' Provident Fund (EPF) members to raise and resolve grievances related to their EPF accounts, UAN, KYC updates, claim settlements, and more.

Here’s a step-by-step guide to registering a grievance:

- Visit the EPFiGMS portal: https://epfigms.gov.in/

- Click on "Register Grievance."

- Select your status (PF member, EPS pensioner, employer, or others).

- Enter your UAN, PPO, or establishment numbers (if applicable).

- Provide personal details, grievance details, and supporting documents.

- Submit your grievance.

- You will receive a registration number to track the status of your grievance.

Employees' Provident Fund Organisation (EPFO)

The Employees' Provident Fund Organisation (EPFO) is the government body responsible for administering the EPF and its associated schemes. Established in 1951, the EPFO has emerged as a leading social security organisation globally, serving millions of employees and pensioners.

The EPF is a mandatory scheme for organisations with 20 or more employees. It operates as a retirement savings plan where both employees and employers contribute a portion of the employee's salary each month.

This accumulated amount, along with the interest earned, forms a substantial corpus that employees can utilize upon retirement. Below are the details regarding the EPFO:

- Eligibility: All employees in organisations with 20 or more employees are automatically enrolled in the EPF. Smaller organisations can also voluntarily opt into the scheme, extending its benefits to a wider workforce.

- Contributions:

- Employee's Contribution: Employees contribute 12% of their basic salary and dearness allowance (if applicable). This contribution is automatically deducted from their monthly salary.

- Employer's Contribution: Employers match the employee's contribution, also contributing 12% of the basic salary and dearness allowance. This contribution is further divided into:

- 8.33% is directed towards the Employees' Pension Scheme (EPS) to secure pension benefits for the employee after retirement.

- 3.67% is credited to the employee's EPF account.

- 1% is used for administrative and insurance charges, ensuring the smooth functioning of the scheme and providing life insurance coverage under the EDLI scheme.

- Attractive Interest Rate: The EPF offers a competitive interest rate, typically ranging between 8.15% and 8.25% per annum. This interest is compounded annually, leading to significant growth of the accumulated funds over time.

- Tax Benefits:

- Deductions under Section 80C: Contributions made to the EPF are eligible for tax deductions under Section 80C of the Income Tax Act, up to a specified limit. This allows employees to reduce their taxable income and save on taxes.

- Tax-Free Withdrawals (Conditions Apply): In most cases, the interest earned and withdrawals from the EPF are tax-exempt, provided certain conditions are met. One key condition is completing five years of continuous service. This tax-free benefit makes the EPF a highly attractive savings option.

Benefits and Features

The EPF offers a range of benefits designed to secure your financial future:

- Retirement Benefits: Upon retirement, employees receive a substantial lump sum amount. This includes their contributions, the employer's contributions, and the accumulated interest earned over the years. This lump sum can be used to meet various post-retirement expenses and goals.

- Pension (EPS): The Employees' Pension Scheme (EPS) is linked to the EPF and provides a regular monthly pension to employees after retirement. This ensures a steady income stream and financial stability during the retirement years.

- Life Insurance (EDLI): The Employees' Deposit Linked Insurance Scheme (EDLI) is another significant benefit linked to the EPF. It provides life insurance coverage of up to ₹7 lakhs to employees. In case of the unfortunate demise of the employee, the nominated beneficiary receives this sum assured, providing financial security to the family.

- Emergency Withdrawals: The EPF scheme understands that emergencies can arise, and thus allows partial withdrawals under specific circumstances. These include medical emergencies, home purchases, higher education, marriage, and unemployment (after a specific waiting period). While withdrawals before retirement are generally discouraged, the EPF provides this flexibility to address urgent financial needs.

- Universal Account Number (UAN): Each EPF member is assigned a unique 12-digit Universal Account Number (UAN). This UAN remains the same throughout the employee's working life, regardless of job changes. It acts as a portable account, making it easy for employees to transfer their PF balance from one employer to another.

UAN - Universal Account Number

The Universal Account Number (UAN) is a unique 12-digit number given to every employee involved in the Employees' Provident Fund (EPF) scheme, overseen by the Employees' Provident Fund Organisation (EPFO) in India.

The main function of the UAN is to consolidate multiple EPF accounts that an employee might have with various employers into one unified account. The UAN stays the same throughout an employee's career, no matter how many jobs or companies they switch.

Helpline

For queries related to the EPF, you can contact:

| Query | Contact Information |

|---|---|

| UAN Helpdesk Number | 18001-18005 |

| UAN Helpdesk Email ID | uanepf@epfindia.gov.in |